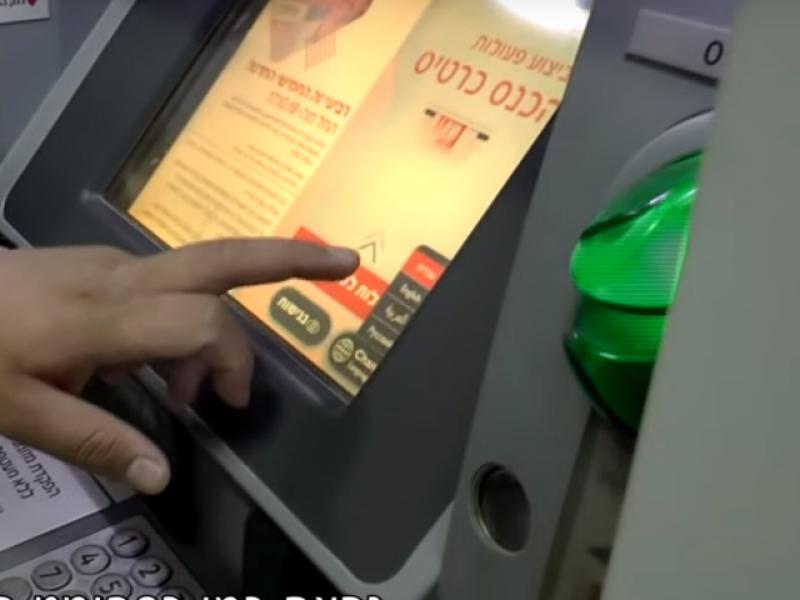

The Supervisor of Banks demanded that Bank Hapoalim compensate customers who suferred by a malfunction that was found in the Bank's ATMs. In December 2018, the media reported a nationwide malfunction in Bank Hapoalim's automated teller machine, in which it was claimed that customers who tried to withdraw cash were charged for the withdrawal attempt and the withdrawal fee, despite the failure of the device and the customers did not actually receive the money. As a result of this information, the Banking Supervision Department began an examination of the Bank's handling of the said malfunctions. Based on the findings of the examination, the Supervisor of Banks required the Bank to identify and compensate customers affected by the malfunction and to take steps to ensure that the problem does not recur. In addition, the Supervisor of Banks imposed a financial sanction in the amount of NIS 1,575,000. In recent months, the Bank has invested considerable resources in dealing with the problem, preventing its recurrence and locating the customers who were harmed in order to return their money.

An examination carried out by the Supervisor of Banks revealed that most of the withdrawals were normal, and that when a drawdown failed, an automatic credit was usually made by the Bank's systems. However, in cases where the failure occurred, the Bank did not inform customers of it, did not proactively locate the customers who were not automatically credited, and did not arrange for the full refund of the funds and fees charged for the service that was not actually provided. In the cases of failure found, it was found that the Bank's conduct was inconsistent with Proper Conduct of Banking Business Directive No. 433 (erroneous registration in the customer's account) and with Section 9J of the Banking (Service to Customers) Law, 5741-1981, which deals with the collection of commissions.

In view of the findings of the examination, the Supervisor of Banks instructed Bank Hapoalim to identify all the customers who have not received money in cash withdrawals over the past seven years. Bank Hapoalim is currently working to recover the full amounts and commissions collected from its customers and customers of other banks that have been harmed, and has reported to the Supervisor that a large number of customers have already been acquitted, and continues to act to credit the additional customers.

The Bank has taken steps to minimize the difficulties in withdrawing cash from the devices and the potential harm to its customers, and the Supervisor was impressed that the problem had been corrected. In addition, the Bank has taken steps to provide services to customers, including: extended call center hours for technical support. When the customer identification process and the refund are completed, the Bank will be required to publish data regarding the scope of the problem and the amounts returned.

In addition to the demand to return the funds to customers, and in the wake of these violations, the Supervisor of Banks imposed a financial sanction on Bank Hapoalim for breach of Proper Conduct of Banking Business Directive No. 433, and for breach of Section 9J of the Banking Law (Customer Service), in the total amount of NIS 1,575,000. The amount is determined after a reduction of 10% of the maximum amount that can be collected against these violations in accordance with the amortization rules prescribed by law. The decision to reduce the amount of the financial sanction as aforesaid was based on the Commissioner's impression of the many and effective actions taken by the Bank to correct the deficiencies and prevent their recurrence.

Articles Archive

Top Categories

ABOUT IFI TODAY

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum

Comments